U5 Termination Expungement & Moving Your Book of Business

Over the past few years, there has been a growing trend in which FINRA member broker-dealers use the Form U5 to damage brokers’ reputations and discourage clients from following them to new firms.

When brokers are fired or leave for any other reason, or for no reason other than that they want to go somewhere else, a summary of the U5 appears on FINRA’S BrokerCheck database and can put a broker in a less than positive light or downright defame them. A quick Google search of a broker’s name will pull up this information.

Firms often use the U5 as a competitive tool to hang on to brokers’ clients. In addition to language explaining why the broker is no longer with the firm, depending on what boxes are checked on the U5 a broker can look like they’re under “internal review” or some other vague information.

Even Congress has raised questions about securities firms’ alleged abuse of the Form U5, and in December 2016, FINRA reached out to former Wells Fargo employees to gather information about “instances where they believe there are material issues associated with the processing of their Form U5, including the accuracy and completeness of the language filed by Wells Fargo Advisors.”

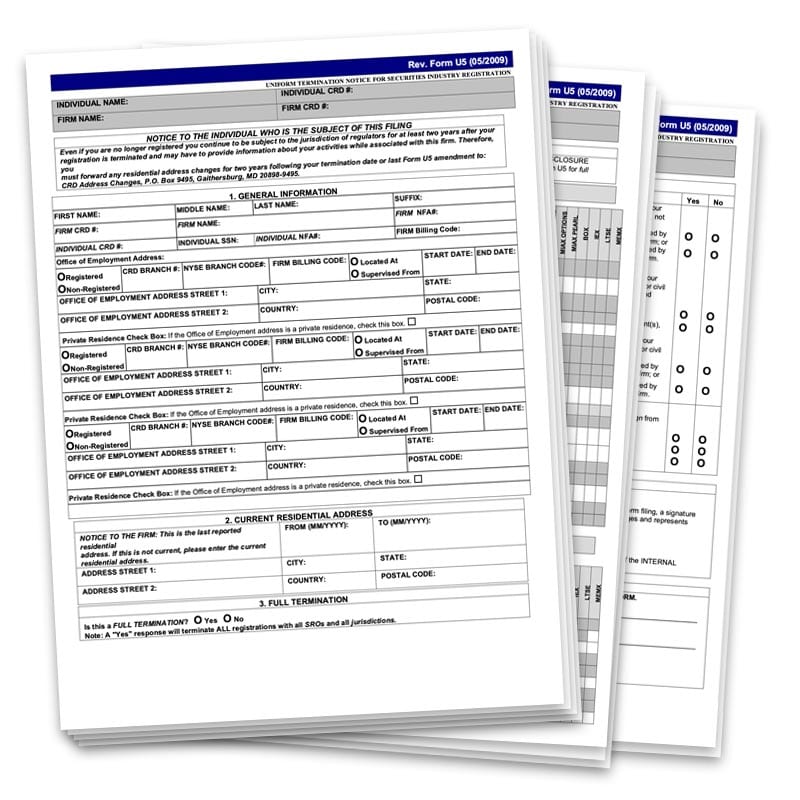

It’s important to fill out the 24-page U5 form correctly, properly, and ethically. Let us help you do this right and avoid liability.

Sanctions can be severe for putting false or defamatory information on a broker’s U5. FINRA can bar or suspend firms and/or responsible principals for filing false, misleading or inaccurate information and fine individuals as much as $73,000, according to FINRA’s more recent guidelines. A principal consideration in determining sanctions includes whether a firm’s filing misconduct “resulted in harm to a registered person,” the guidelines say.

The temptation to use U5 filings aggressively can be a double-edged sword for broker-dealers.

Just filling out the U5, due within 30 days of a broker leaving the firm, is fraught with pressure as compliance officers and supervisors balance FINRA reporting requirements and the goal to retain customer assets against the risk of defamation claims.

Brokers’ lawyers and firms often negotiate for weeks on the wording of U5s, which can be an expensive process for the departing financial advisors.

In-house lawyers are also counseling branch and regional managers to be extremely cautious in the persuasion tools they use to retain assets of departed brokers. It takes experience and objectivity to do this right. Even then, the lawyers themselves can end up named in a defamation lawsuit.

If you are a supervisor or internal counsel or CCO, call us to help you do this right and avoid liability. If you are a broker who has been defamed, call us to help you get your U5 expunged.

Our Law Office Provides Legal Counsel & Representation for Brokers in Employment-Related Law.

Moving Your Book of Business

Employment Transition Strategies

Non-Solicit/Non-Compete Agreements

TROs and Injunctions

Read More »

Corporate Raiding

Dodd-Frank Whistleblower Program

Employment Agreements

Independent Contractor Agreements

Employee Handbooks and HR Policies

Are You Ready to Talk About Your Situation?

Contact the Attorneys at Law Offices of Christopher H. Tovar, PLLC.

"*" indicates required fields

Securities Practice Group

The Law Offices of Christopher H. Tovar, PLLC are headquartered in Southeast Michigan. Christopher H. Tovar is licensed in Michigan, Texas, Florida, New York, and Illinois and operates nationwide.*

* Michigan, Florida, Illinois, California, and New Jersey require bar membership to arbitrate FINRA cases in their jurisdictions. The Law Offices of Christopher H. Tovar, PLLC maintains relationships with attorneys in all 50 states and can arbitrate your case on a pro hac basis.

Tags: U5 termination expungement attorney U5 termination attorney U5 FINRA termination